There is a lot of noise on the internet. And there is a lot of noise in finance. When you hear people talking about finance on the internet, it’s nots surprising many find it completely overwhelming. That’s why I created this page. I wanted one place to send my friends and family if they needed to know how to get started with investing. A place I could trust, and not have to worry about what it said.

You know how there is always a “tech kid”, well I was always the “personal finance nerd”. I’ve taught many people to invest over my life, not one person has regretted it. This article is an amalgamation of that knowledge, and those years of questions.

What actually is investing?

If you are going to do something, you should understand it. I could just tell you some steps to blindly follow, but if I did it is likely you would tuck tail and run as soon as times got tough. That is not what investing is about.

Investing (in companies) is simply investing your money into a company, and taking a proportionate piece of its success (and failure). We all know what a landlord is, well imagine you invest £1,000 in a £100,000 property that someone else buys to rent out at £1000 per month. You, in theory, would be entitled to 1% of all future earnings of that property – in this example that would be £10 per month in income.

If the house went up in value (over many years) to £200,000 your investment would be worth £2000. At the same time, the rental market may have shifted so you are now charging £2000 per month in rent. Because you still own 1%, you would be making £20 per month but still have your £2,000. This £1000 increase is a capital gain. The £20 per month is income.

Most of us know what “investing” is, where people get lost/scared/confused is the stock market. The stock market is big and scary, and for many years it was really difficult for the average person to invest in it for a range of reasons. But you see, the stock market is precisely the same as the above example. Just with a hell of a lot more noise.

If you buy stock in a singular company on the stock, you are buying a share of the company. Their debts, income, assets, revenue, and profits. The value of your share changes as these things do.

“Public companies” are just companies that anyone one can invest in via a stock market. The stock market is just like any market, it rises and falls based on supply and demand for something. If there is only one bottle of water left on a dessert island, it’s going to be worth a lot more than at your local Tesco. When you hear a company “going public” it just means they are allowing the public to buy a portion of their stock.

Example: If a company is worth £100, it might offer 10% of the stock at £1 per share. For easy maths, each share is worth 1% of the company. However, when the company puts these shares onto the market there may be excessive demand for them, bidding these 10 shares up to £2 per share. As the total shares in issue are 100, the company is now worth £200. You don’t need to know much more than that at this point.

You can buy individual companies and make (and lose) a lot of money, but most financial advisors will tell you to buy tracker funds or ETFs (exchange traded funds). This sounds complicated but it’s is not.

ETFs are a collection of companies that you can buy all at once. Think of it as a basket of goods from the supermarket, but each item you buy is a sector or geography. For example you can buy the “FTSE All-World UCITS ETF (VWRL)” from Vanguard, which allows you to buy a very small piece of every public company in the world in one transaction. It’s that simple. It’s a way to take every piece of the action, and gain money as the global economy grows.

There are ETFs for almost anything these days, here are a few examples:

- QQQ: Tech stocks (very volatile – moves up and down a lot)

- VOO: Biggest 500 listed companies in the US

- Emerging Markets Stock Index Fund (VANEMPA) – which focuses on emerging markets such as India and Brazil.

The all world ETF is considered the lowest risk way to invest in equities (stocks), and is a good place to get started. If you are reading this and are under 30, even 40, you are likely to want to be 100% in equities. The closer you are to retirement, the lower proportion you will want to have (as you will need a guaranteed income).

Am I Already Invested in the Stock Market?

Yes, you probably are. Well, probably.

If you have a pension, which every company in the UK now must offer to permanent employees, then you are very likely to be invested in the stock market already.

Typically your pension provider will invest your funds in pretty safe stuff. Which is good, except you will miss out on a lot of the bigger returns for this safety. We will tackle this problem at a later date. For now, if you have a pension, you are 99% invested in something. So you are already exposed to the stock market, whether you like it or not.

Before you start investing (for yourself)

Before you start investing in the stock market, it is good practice to get your finances into order. This is not essential, as you can start with as little as £25 per month, but it is what I would do. I found having my finances in order made the whole thing less stressful.

For good measure here is what I would focus on before you start investing

- Pay down high interest debt

- Credit Card debt (or similar) is often at such a high interest rate that the best use of your money is to pay down this debt. This will give you more money each money to invest/save and increase your wealth in the long-term

- Save up 3 months expenses

- depending on your circumstances this can be much higher or much lower. For example if you are living at home your expenses are very low you can be quite light on cash. If you are self-employed you might want as much as 12 months.

- Cut back expenses to get to at least 10% savings rate,

- not essential, but you need to be investing from disposal income, that you won’t need in the short or medium term. The higher the savings rate the better.

All of this is negotiable, but it will help you stay the course when times get tough. You can’t be investing if you need to sell shares each month to cover your heating bill. Invest what you don’t need now, so you can have what you do need in the future.

How To Invest?

Now you have the fundamentals, and you understand what you are doing (to some degree) you can start to invest.

There are 3 key steps here:

1.) Choosing a provider through which to buy shares

2.) Opening & funding your account

3.) Investing in your ETF of choice

Let’s break down the options for each

1.) Broker Choice

I personally use Trading212, as it has no fees, and cash interest rate of 5.17% (as of Nov 2024). But I’d say Vanguard is equally simple to use, and won’t tempt you to do anything crazy with your money.

I’ve also used (and invested in) FreeTrade.io but they aren’t as cheap, and don’t offer as much as Trading212 (no daily interest) and are more limited in their stock/ETF selection unless you buy their premium account – and I say this as an investor in the company.

Other providers (for sake of fairness) in the UK are IG, Hargreaves Lansdown, and Interactive Brokers (and perhaps US-based RobinHood and WeBull too).

Let’s assume you use Trading212 or Vanguard. Opening an account is fairly simple just follow their instructions on these pages:

Trading212: Open an ISA

Vanguard: Opening an ISA

What is an ISA?

Ideally, you want to open a stocks and shares ISA (Individual Savings Account), this is a UK only scheme that allows you to save or invest up to £20,000 per year without incurring any tax on future gains or income. If you don’t do this, and come to sell, you might well have to pay up to 24% of your gains in capital gains tax (as of October 2024 Labour Budget), and dividend tax on any dividends accrued. You want to avoid this headache altogether and just keep your money inside the ISA.

2.) Funding

Lump Sum vs Regular Saving

Once you have completed your setup, you need to fund the account.

The best way to this over the long-term is to setup a regular contribution that comes out the same day as your paycheck. This could be £25 per month, or whatever you feel comfortable contributing. As we established before, little and often can lead to large gains in the future. Just getting the snowball started as early as possible is important.

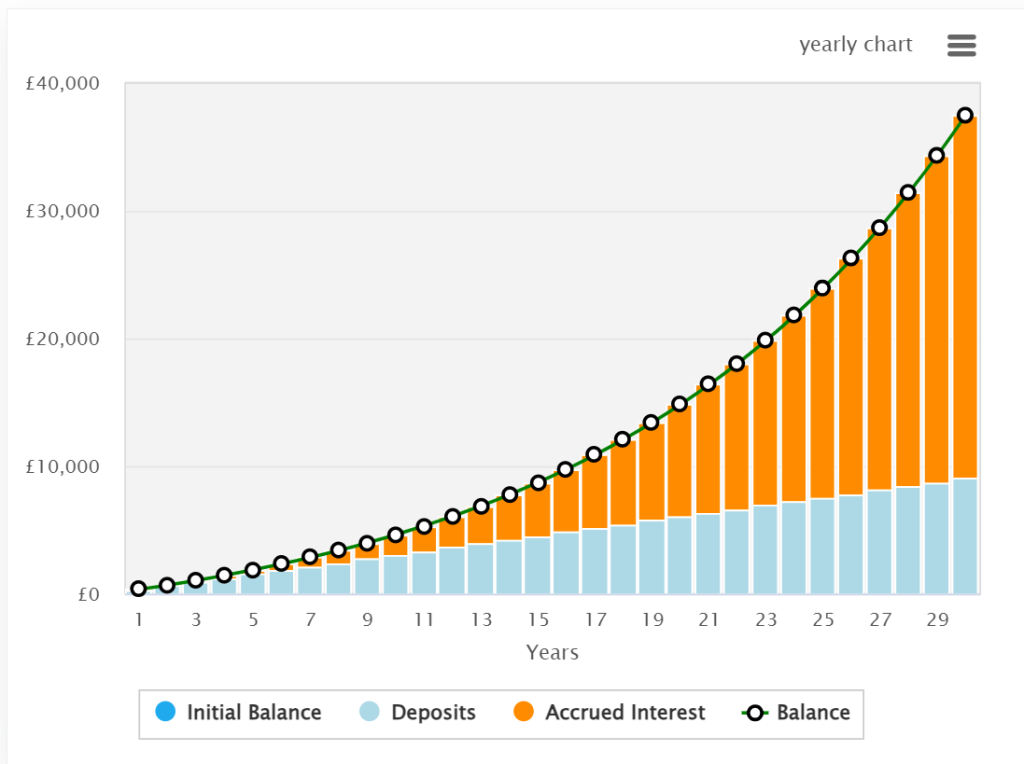

To give you a flavour, here is what £25 per month invested in the S&P500 over 30 years could result in:

Alternatively, you can lump sum some money into your account. Trading212 has the smallest minimums here, Vanguard requires £100 for a lump sum contribution.

If you get stuck here is a guide (not me!) or opening the account from end to end.

3.) Buying your stock/ETF

Now you have money in your account, you can buy your first ETF. I am buying the S&P500 UK ETF here, and choosing “accumulation” as I want the money to be reinvested to buy more units of the ETF.

In Vanguard it should look something like this:

In Trading212 it would look like this:

It’s that really that simple.

What now?

Wait. Sit on your hands. Do nothing.

This is the hardest part of investing. In fact, the best performing investors are those that have lost their account logins. Go and live your live your life knowing that you have taken steps to secure your future finances.

Now you are setup you can just allow your regular deposits to go out each month, and focus on earning and/or saving more to enable you to invest more in the future.

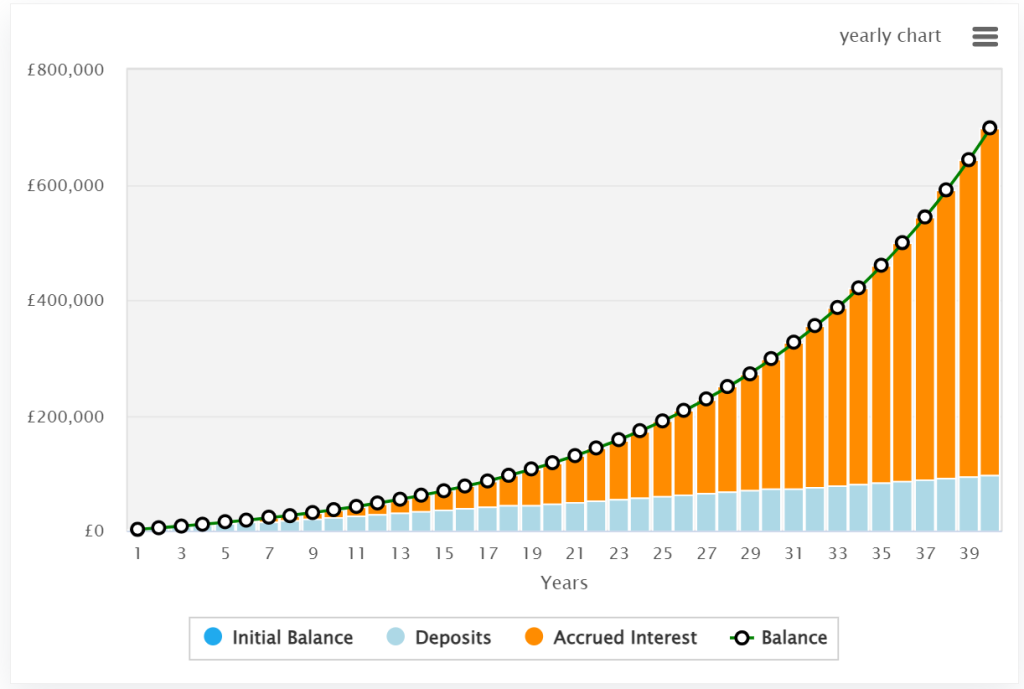

As you will see from the below chart the earlier you get started the better:

If you have any questions, I will leave the comments open below. I will do my best to respond to them in a timely manner. None of the above should be considered financial advice.

Leave a Reply